One Company. One Call.

Solutions to simplify business communications.

One Company.

One Call.

Solutions to simplify business communications.

One Company.

One Call.

Solutions to simplify business communications.

One Platform for All Your Communications Needs

Manage calls, voicemails, business texts, video conferencing, and more on any device, and from any location.

One Platform for All Your Communications Needs

Manage calls, voicemails, business texts, video conferencing, and more on any device, and from any location.

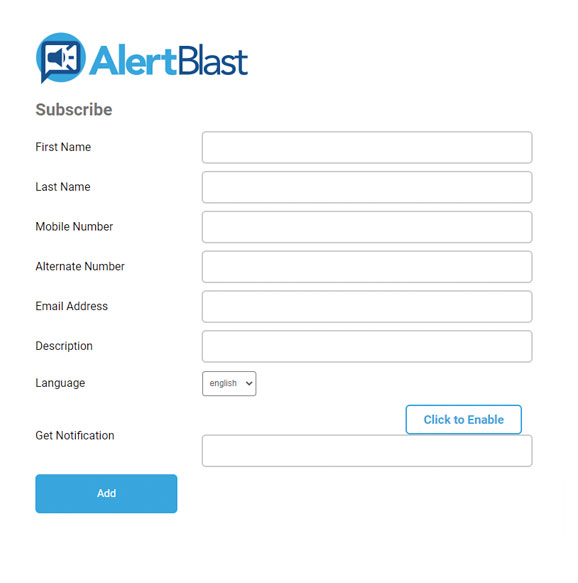

Simple

Pre-configured and ready to go without the need for an IT guru. Use on all your devices.

Scalable

Complete system with robust features that adapt as you needs change.

Secure

Enjoy enterprise-grade security and the reliability of a 99.999% uptime SLA.

Support

The importance of 24x7 local, human support cannot be overstated.

Infrastructure Designed For Growth

Efficient and effective infrastructure, including cabling, server racks, access control systems, paging, and more, can be the key difference that sets your company apart from the competition.

Infrastructure Designed For Growth

Efficient and effective infrastructure, including cabling, server racks, access control systems, paging, and more, can be the key difference that sets your company apart from the competition.

IP Services

Whether you need copper or fiber-optic structured cabling added to an expansion suite, or a new VoIP-hosted phone system in a growing office, we've you covered.

Customized Data

From data-center installation to intelligent cabling-management software, our experienced technicians will walk you through every step of the deployment.

Scalable Solutions

Whether you're working on a new construction or retrofitting an existing space, we offer communications infrastructure for businesses of all sizes.

Hassle-Free Installation

No project is too small or complex for us. Our experienced and knowledgeable team will handle it all to bring your vision to fruition.

Support That Sets Us Apart

We're a technology company, but it's our people that really differentiate us from the competition. Our white glove approach to consultation, design, installation, and support delivers on the promise of truly a personalized experience that always puts the customer first.

Support That Sets Us Apart

We're a technology company, but it's our people that really differentiate us from the competition. Our white glove approach to consultation, design, installation, and support delivers on the promise of truly a personalized experience that always puts the customer first.

Support That Sets Us Apart

We're a technology company, but it's our people that really differentiate us from the competition. Our white glove approach to consultation, design, installation, and support delivers on the promise of truly a personalized experience that always puts the customer first.

“They offer highly skilled and knowledgeable staff with a fantastic work ethic.”

“They offer highly skilled and knowledgeable staff with a fantastic work ethic.”

Our Solutions Are Trusted by Businesses Large & Small

Our Solutions Are Trusted by Businesses Large & Small